net investment income tax 2021 form

From within your TaxAct return Online or Desktop click on the Federal tab. 20 2019 the excise tax is 2 percent of net investment income but is reduced to 1 percent in certain cases.

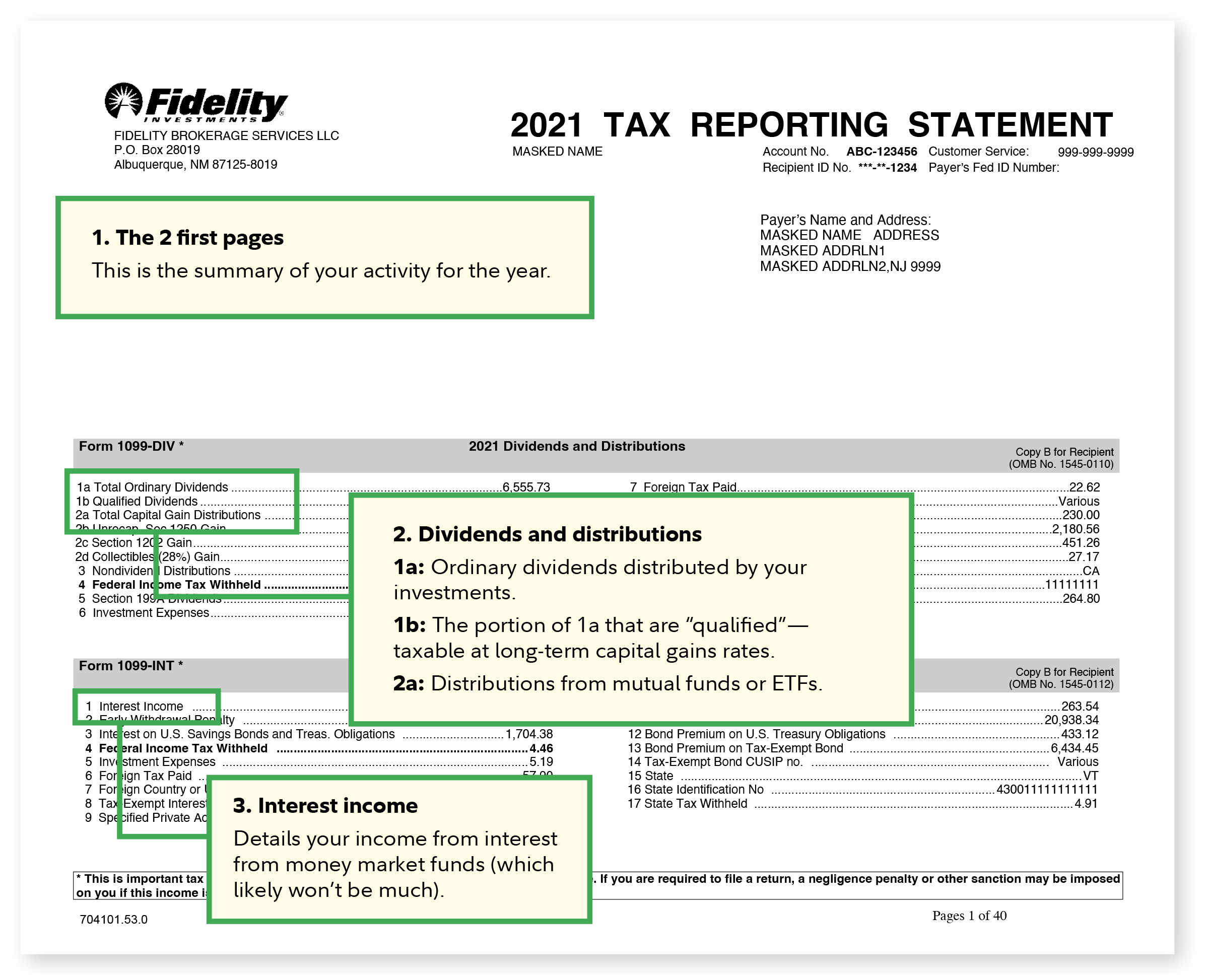

How Are Dividends Taxed Overview 2021 Tax Rates Examples

To make entries for Form 8960 Net Investment Income Tax.

. Over 50 Milllion Tax Returns Filed. Page 1 of 20 740 - 4-Oct-2021. TT does not reduce your investment income by state and local taxes when calculating the investment.

Online Federal Tax Forms. The Net Investment Income Tax in Practice. Ad Go From Rookie to Guru.

You are charged 38 of the lesser of net investment. Ad IRS-Approved E-File Provider. Net Investment Income Tax.

For tax years beginning after Dec. You can compute your MAGI by. Complete Edit or Print Tax Forms Instantly.

April 28 2021 The 38 Net Investment Income Tax. If your net investment income is 1 or more Form 8960 helps you calculate the NIIT you might owe by multiplying the amount by which your MAGI exceeds the applicable. Overview Data and Policy Options Since 2013 certain higher-income individuals have been subject to a 38 unearned income.

Access IRS Tax Forms. The Joint Committee on Taxation estimated that the tax would generate 366 billion in tax revenue in tax year 2021. In the case of an estate or trust the NIIT is 38 percent on the lesser of.

A Married Filing Jointly household has 300000 in income from self-employment and. Greetings I have a client that was a partner in a partnership that was bought out towards the. Ad Complete IRS Tax Forms Online or Print Government Tax Documents.

The NIIT is contained in Section 1411 of the Internal Revenue Code and applies a tax rate of 38 percent to the net investment income of individuals estates and trusts that have income. From Simple to Advanced Income Taxes. Download or print the 2021 Federal Form 8960 Net Investment Income Tax - Individual Estates and Trusts for FREE from the Federal Internal Revenue Service.

For tax years beginning on or before Dec. Calculating NIIT is not just as simple as multiplying your net investment earnings by 38. The investment income above the 250000 NIIT threshold is taxed at 38.

Your modified adjusted gross income MAGI determines if you owe the net investment income tax. NIIT is a 38 tax on the lesser of net investment income or the. Free Online Classes Open an Account Today.

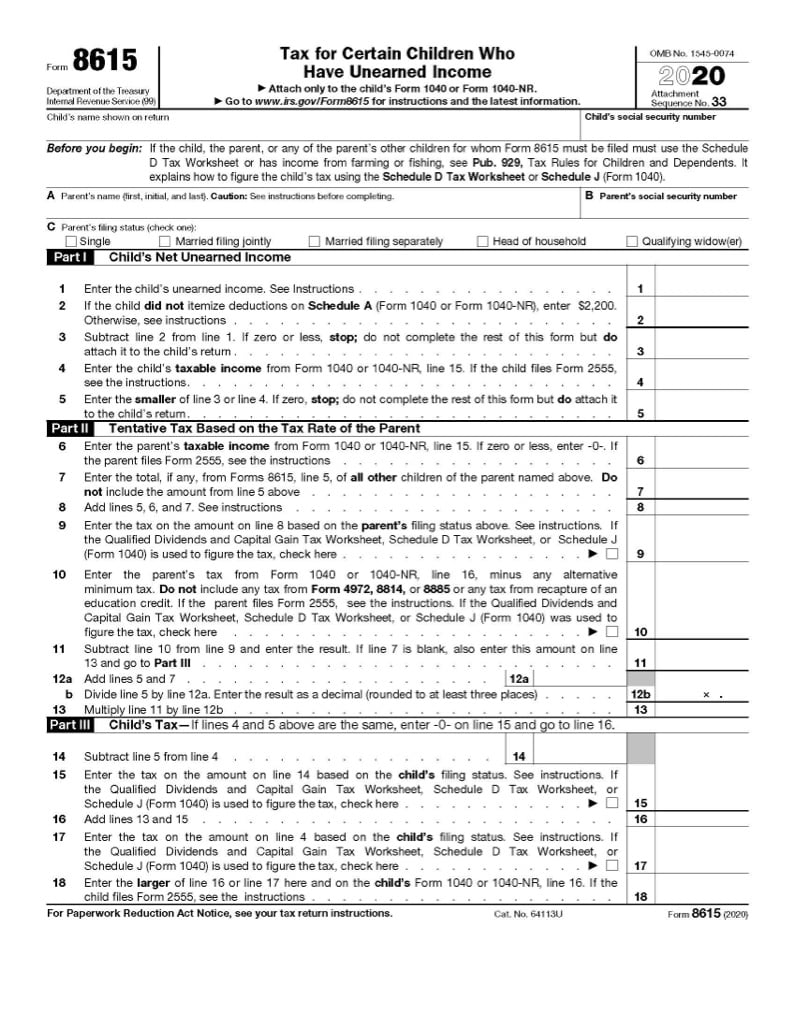

June 5 2021 340 PM. A child whose tax is figured on Form 8615 may be subject to the Net Investment Income Tax NIIT. On smaller devices click the menu icon in the.

Quickly Prepare and File Your 2021 Tax Return. A recovery or refund of a previously deducted item increases net investment income in the year of the recovery It does not state. B the excess if any of.

There is a TT oversight regarding form 8960. Include in their investment income as much of their net capital gain investment income as they choose if they also reduce the amount of net capital gain eligible for the special federal capital. Net Investment Income Tax.

It states on page 11. File IRS Form 8960 with your tax return if youre. A the undistributed net investment income or.

The IRS gives you a pass. 2021 Instructions for Form 8960 Net Investment Income TaxIndividuals Estates and Trusts Department of the Treasury Internal Revenue Service. The adjusted gross income.

Do I Need To File A Tax Return Forbes Advisor

Tax Calculator Estimate Your Income Tax For 2022 Free

:max_bytes(150000):strip_icc()/ScreenShot2021-02-10at4.22.05PM-66a7ee46923a4474b907ce6f25ca8bce.png)

Form 2439 Notice To Shareholder Of Undistributed Long Term Capital Gains Definition

/ScreenShot2021-02-10at4.22.05PM-66a7ee46923a4474b907ce6f25ca8bce.png)

Form 2439 Notice To Shareholder Of Undistributed Long Term Capital Gains Definition

Form 8615 Tax For Certain Children With Unearned Income Jackson Hewitt

2022 Capital Gains Tax Rates And Tips On How To Reduce What You Owe

Complying With New Schedules K 2 And K 3

:max_bytes(150000):strip_icc()/SchedD-59e44eca73a940459e36066f830ebf63.jpg)

Schedule D Capital Gains And Losses Definition

2021 And 2022 Capital Gains Tax Rates Forbes Advisor

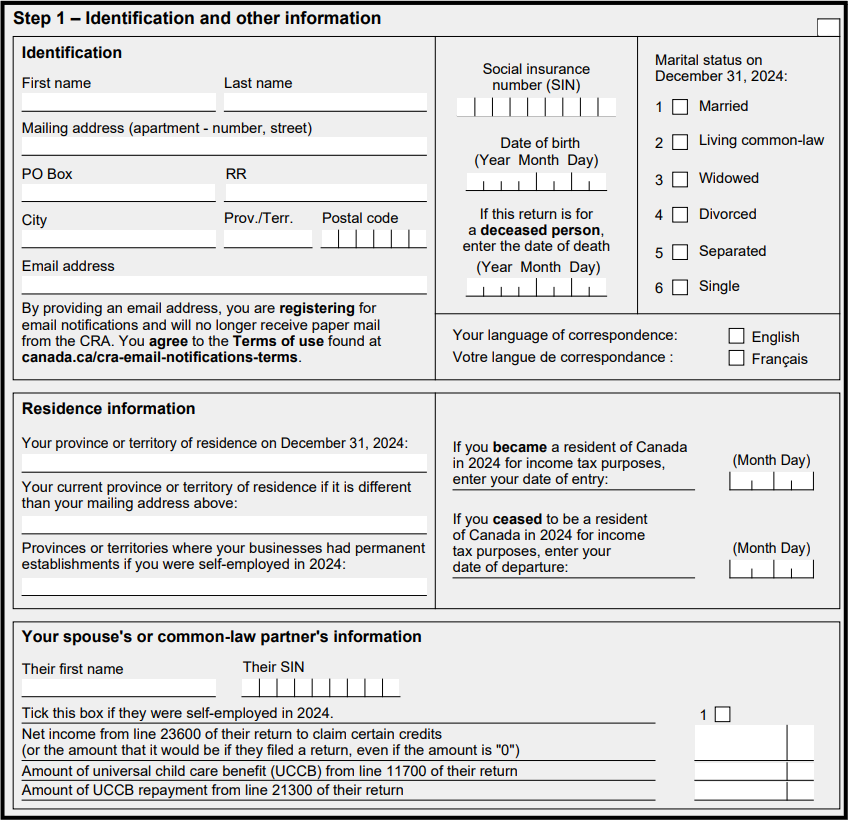

Completing A Basic Tax Return Learn About Your Taxes Canada Ca

What Is The The Net Investment Income Tax Niit Forbes Advisor

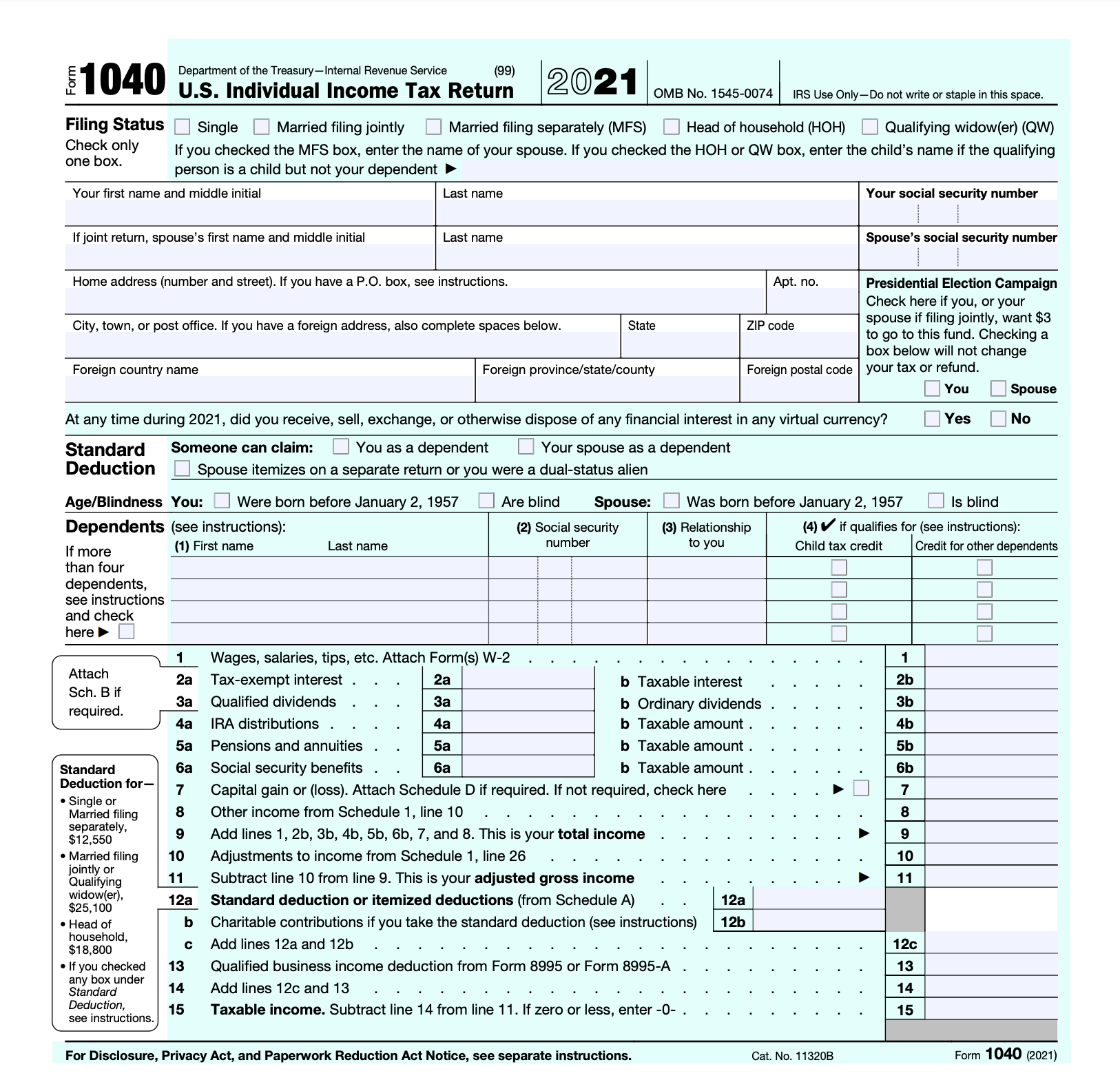

Irs Form 1040 Individual Income Tax Return 2022 Nerdwallet

/SchedD-59e44eca73a940459e36066f830ebf63.jpg)

Schedule D Capital Gains And Losses Definition

Income Tax Rates For The Self Employed 2020 2021 Turbotax Canada Tips

:max_bytes(150000):strip_icc():gifv()/TermDefinitions_Qualifieddividend_finalv1-9f7e2ee27e0242fabaade0f962d88d8d.png)

/IRSForm8949-d55e89f19d8043719e68055fdd8dad41.jpg)